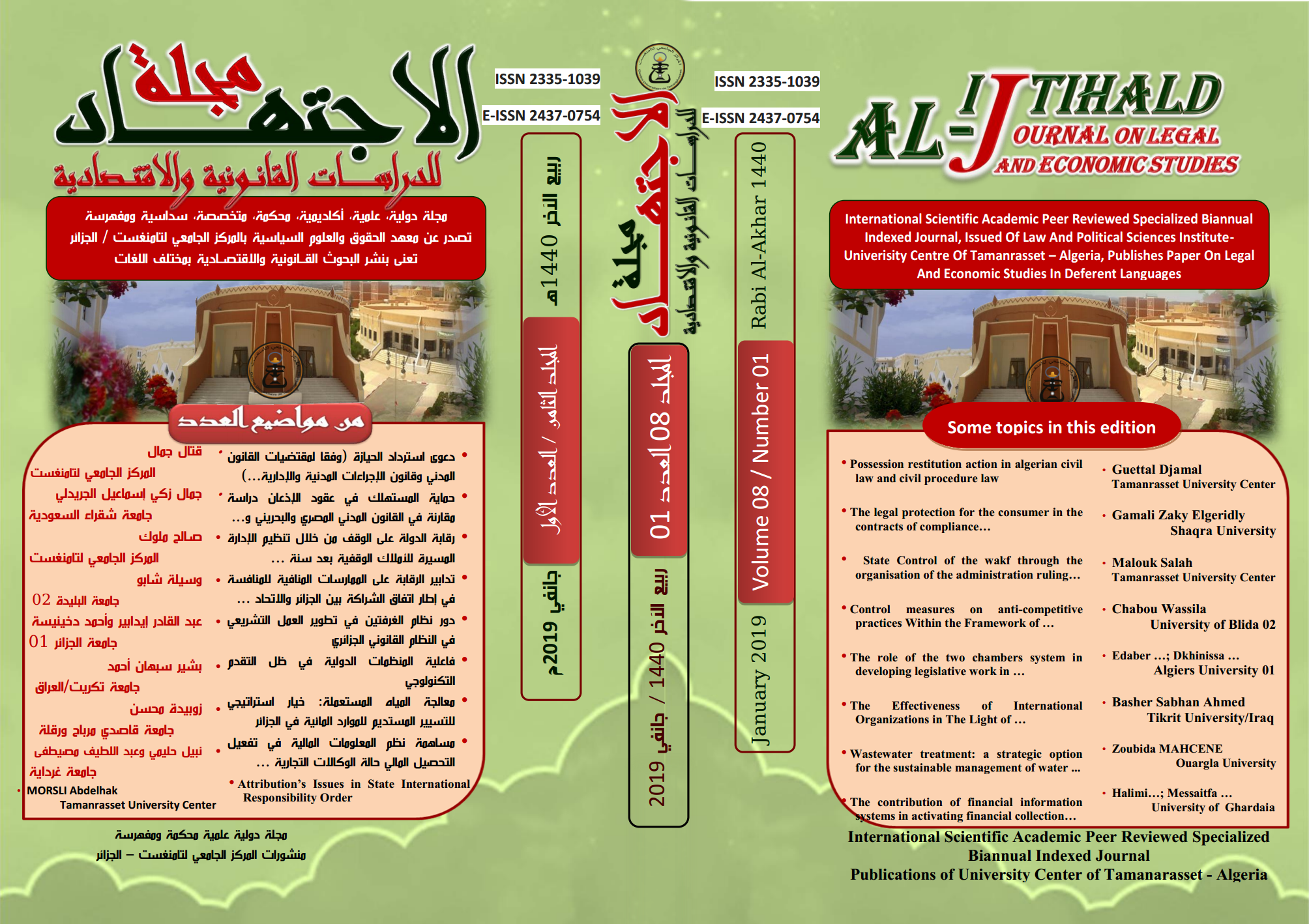

Integration between Islamic social finance and financial inclusion in the light of the purposes of Islamic law

DOI:

https://doi.org/10.36540/ns9s4385Keywords:

Islamic social finance, financial inclusion, integration, financial transactions, the purposes of ShariaAbstract

The integration between Islamic social finance and financial inclusion represents the most accurate form of the development of the contemporary Islamic economy, and it works to achieve the two objectives of building the earth, the prosperity and development of money, reducing poverty and unemployment, achieving economic empowerment and sustainable development, self-sufficiency and achieving prosperity and economic well-being.

The importance of this integration is due to: achieving the meaning of slavery in its integrated sense, achieving the objectives of the royal states, achieving social empowerment, which is a path to political empowerment, and contributing to the promotion of Islamic banking activity.. Among the means that support it: providing infrastructure, enacting regulatory and supervisory laws, and spreading financial culture. Banking awareness in society, providing services based on the use of digital financial technologies, and seeking the assistance of social experts to know the needs of each environment.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Alijtihed Journal on Legal and Economic Studies

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

This work is licensed under a

Creative Commons Attribution-NonCommercial 4.0 International License.