The Importance of Fiscal checking For Management in Fiscal Administration - An Applied Study in the The First November Tax Inspectorate , Ghardaia.

The Importance of Fiscal checking For Management in Fiscal Administration - An Applied Study in the The First November Tax Inspectorate , Ghardaia.

DOI:

https://doi.org/10.36540/2p27se29Keywords:

Tax Verification, Administrative Control, Tax Services, Internal Control, AuditorAbstract

The Fiscal checking For Management is one of the internal control mechanisms that the tax administration resorts to in evaluating the performance of its interests through the use of a set of methods and procedures that enable it to eliminate many errors and deviations committed by tax agents against the taxpayers, whether they were inadvertently or intentionally in order to ensure that performance safety.

From the aforementioned, the focus will be on the mechanisms used by the General Inspectorate of Tax Interests, which are carried out by the tax administration inspector, which gives it the authority to exercise administrative control over the tax interests at all levels.

The role of the Inspectorate for Tax Interests lies in dealing with errors and imbalances in tax authorities and working to prevent them from recurring, in accordance with the laws and instructions approved by the tax legislature. checking The performance presented to the taxpayers, whether positively or negatively.

Downloads

Published

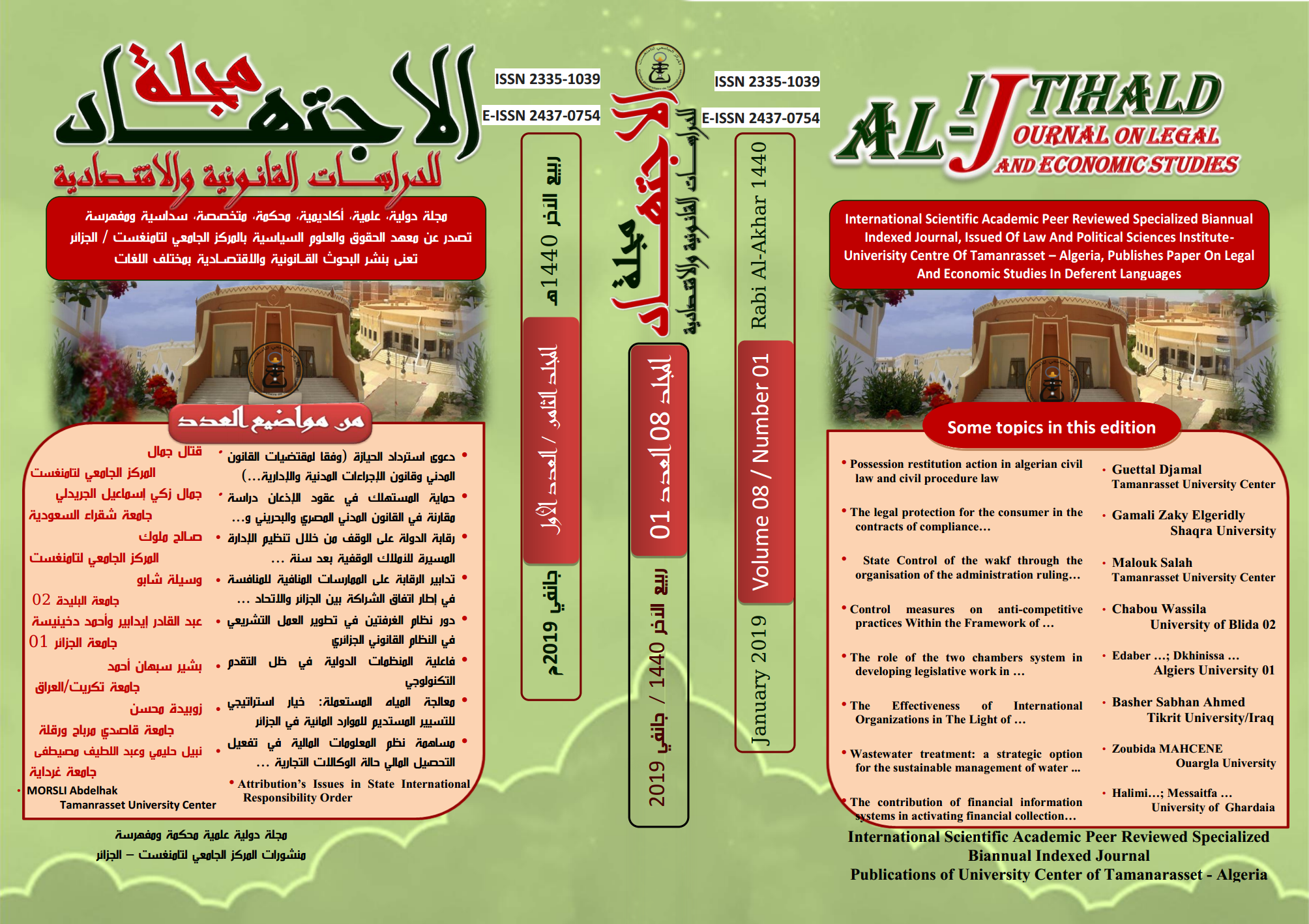

Issue

Section

License

This work is licensed under a

Creative Commons Attribution-NonCommercial 4.0 International License.